The path to net zero for SMEs: ESG and carbon accounting software deep dive 2024

ESG and carbon accounting deep dive factbase

At Nesta Investments one of our priorities is to invest in technology that helps SMEs make progress to net zero while raising their productivity. A fundamental activity is understanding their carbon footprint and what action they could take to minimise it while improving the efficiency of their business operations. Meera Shah, Investment Analyst in Nesta’s Impact Investing team, has done a deep dive into this sector and mapped over 290 companies active in the UK, Europe, North America and Asia-Pacific (APAC) region. We wanted to identify any investable ‘white spaces’ in this market. Our market map is not exhaustive and is a snapshot of a particular moment in time. We welcome suggestions of companies to add to this list and any comments or questions you may have to support building the industry-wide knowledge base in this area.

You can explore our interactive solutions map and our factbase (including EU and UK regulatory context).

Summary

- Venture capital investment into the broad area of climate fintech has increased in recent years, with particularly rapid growth seen in the last two years. With $2.9 billion invested globally, 2022 saw 142% year on year growth from 2021 ($1.2 billion invested globally) and was over three times the 2020 total. 2023 matched this with $2.3 billion invested across Europe and the US.

- Existing and emerging regulations, such as the Corporate Sustainability Reporting Directive (CSRD) in the EU and the Companies Climate-related Financial Disclosure Regulations (CR22) in the UK, are driving the need for solutions. These regulations currently affect large corporations and financial institutions, which will need to report on their emissions, climate risks and opportunities through annual disclosures. SMEs are not currently required to disclose against any frameworks, but they will be impacted by supply chain reporting for their corporate clients and finance providers.

- There are many well-financed solutions for carbon accounting and an increasing number of entrants to the market. These solutions are mainly focused on large corporates.

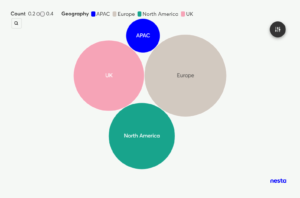

- Europe is the largest market, by number of companies, which is expected given the pace of regulation compared to North America and APAC. This is highlighted in the diagram here, with the bubbles representing the number of companies in each region offering ESG and carbon accounting tools.

Source: Nesta Investments

- We anticipate a rise in US activity once the recent Securities and Exchange Commission (SEC) ruling on climate information disclosure across scopes 1 and 2 is unpaused. Some individual States have introduced climate information disclosure across scopes 1, 2 and 3. The introduction of subsidies and tax breaks under the Inflation Reduction Act (IRA) in the US may also generate the need for climate data disclosure solutions to evidence impact.

- There is not much technical differentiation between products. The common functions are:

- data collection

- measurement

- goal setting

- reduction recommendations

- reporting.

- However, some platforms are offering additional features or points of differentiation, such as:

- functionality to enable offsetting

- marketplace models

- support for supply chain management

- financial grade or audit-ready platforms.

- While the market is undoubtedly crowded with the first wave of carbon footprint and ESG reporting solutions, we can see space for innovation in automating life cycle assessments (LCAs) and supply chain management, tracking decarbonisation and reporting on scope 3 emissions, especially with SMEs in mind.

- There is a market timing risk in building solutions specifically targeting SMEs, especially with changes in regulatory timeframes as well as advances in AI. However, given the increasing challenges that they face in managing and mitigating against climate and ESG risk, and the importance of SMEs to the economies of all countries, solutions in this area have the potential to be highly impactful.

- Solutions for SMEs should have features such as high levels of automation and actionable insights, links to support that would otherwise be hard to find (for example, green finance, materials or suppliers), and the ability to share data up and down the supply chain.

Introduction

Environmental, social and corporate governance (ESG) reporting and carbon accounting tools are part of a broader climate fintech category for companies who are operating at the intersection of climate, finance and technology and supporting the transition to a greener economy. Investment into this area has been increasing over the past few years, with $2.3 billion invested across Europe and the US in 2023 and $2.9 billion invested globally in 2022, in spite of overall venture funding declining in this period and dropping to 6-year lows in 2023. This is largely due to regulatory pressures and complex reporting requirements driving the need for solutions to support action on ESG and carbon tracking. Large corporations and financial institutions are being directly impacted by current non-financial reporting deadlines. While SMEs do not currently have the same deadlines, they will be impacted by:

- upcoming scope 3 reporting requirements for any corporates that they supply, or

- financed emission reporting requirements from their finance providers.

At Nesta Investments, we are looking to invest in solutions, such as ESG and carbon accounting tools, that support businesses, and especially SMEs, in the transition to net zero. This is because we believe that the switch to a greener, lower-carbon economy can also increase the UK’s productivity. We focus on SMEs as they represent a significant percentage of employment not only in the UK (~61%) but worldwide (over 50%).

With an increasing number of companies competing for investment in this area, we set out to map the universe and identified 298 companies providing digital tools and intelligence for ESG and carbon accounting across the UK, Europe, North America and APAC. With a demonstrably crowded market, we sought to identify whether there were any tools with differentiating features or market ‘white space’ which could present attractive investment opportunities.

What are the UK and European regulations driving the inflow of capital into this area?

The EU is further ahead than the UK in terms of confirming the detailed regulation and associated reporting timelines for businesses of all sizes. The key regulatory frameworks in place across the two regions are as follows, with a more detailed list and overview provided in the reference factbase.

EU

UK

The FCA also announced TCFD-aligned reporting requirements, which came into force from 1 January 2022 for the largest firms with more than £50 billion in assets under management (or £25 billion assets under administration for asset owners).

|

There are many interconnected frameworks and standards coming into effect on different timescales and requiring differing amounts of information. The need for solutions to support businesses to act on these requirements and make changes in an easy and efficient way is a clear driver for investment in this area. There will also likely be a merging of carbon and financial reporting, especially given that TCFD reporting is completed annually. Software which enables this in a frictionless and secure environment will be in a favourable market position.

Given the large number of businesses operating across both regions, governments and international institutions are under pressure to keep disclosures aligned and minimise burden on businesses. We have therefore looked at solutions outside the UK as part of our landscape mapping as we believe they could, either now or in future, be applicable to the UK.

How much is being invested and where is the investment going?

In terms of geography, it was reported that in 2023 European climate fintech companies raised $1.4 billion, while their US counterparts raised $881 million. Within the category, Sifted reported that the distribution of the $2.9 billion global funding for climate fintech solutions in 2022 was most heavily weighted to carbon accounting solutions ($970 million), with ESG solutions having only 20% of the investment in comparison ($186 million). Pitchbook also reports similar levels of investment into carbon accounting and analytics tools ($1.2 billion) in 2022. With a PwC Strategy& report suggesting a European and North American total addressable market (TAM) of more than €9 billion ($9.8 billion) in 2021, it is easy to see why an increasing number of companies are creating and investing in solutions for this market.

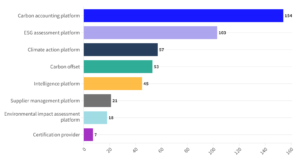

We identified 298 such companies, which we segmented according to the following product groups. Depending on their range of features, companies were assigned one or more product group labels.

| Product group | Definition |

|---|---|

| Carbon accounting platform | Software which analyses and tracks a company’s scope 1,2, and/or 3 emissions. |

| ESG assessment platform | Software which supports the assessment of a company’s ESG credentials. If a company claimed to report on ESG but only offered carbon solutions, these were not included. |

| Climate action platform | Software which facilitates emissions reduction, for example through trajectory modelling, actionable recommendations, link to network of ‘sustainable’ suppliers etc. |

| Carbon offset | Software which supports carbon offsetting, for example through providing a marketplace or services to facilitate purchasing of carbon credits. |

| Intelligence platform | Software which provides aggregated intelligence for businesses, such as competitor/industry ratings or verified data for calculations etc. |

| Environmental impact assessment platform | Software which supports the assessment of a company’s environmental impact, such as through life cycle assessments (LCAs). |

| Supplier management platform | Software which manages supplier data for supply chain reporting, for example through integrations to their data sources. They typically provide features for collaboration, support for supplier decarbonisation etc. |

| Certification provider | Platform/organisation which assesses company claims and provides verifiable kitemarks to prove ESG/carbon credentials. |

Number of companies segmented by product group

Source: Nesta Investments

You can filter solutions by product group, investment dollars raised and geography in our interactive map.

Our segmentation highlights the concentration of companies in the carbon accounting and ESG platform space. When analysing the products further, we found that many of these companies are offering the same set of core features as part of their product, such as data collection (automated or manual), measurement, goal setting and reduction recommendations, and reporting. They are only really differentiated through price point or geographical focus.

To stand out in this market, additional features or points of differentiation offered by some platforms are:

- sector-specific tools, which provide deeper insight or more tailored functionality for investments, retail, food, construction etc

- links or functionality to enable offsetting

- marketplace models with renewable energy providers

- superior technical products, such as accounting/financial grade platforms

- links to/support for suppliers, such as decarbonisation recommendations or easy ways to share data/reporting

- links to/support with obtaining green finance.

Given our focus on SMEs, we completed a high-level mapping on whether the solutions identified could support SMEs. We identified 28 solutions specifically for SMEs and a further ~182 which had solutions for both corporates and SMEs or the potential to support SMEs.

The SME market is highly fragmented, and companies are typically time and resource poor. We believe that investable solutions should therefore have features such as:

- affordable price point and frictionless onboarding

- network effect where there is a benefit to inviting stakeholders onto the platform

- high levels of automation and actionable insights

- links to support which would be hard to otherwise find, such as green finance, materials or suppliers

- ability to link to services, such as accountants and auditors

- ability to share data up and down the supply chain.

However, it is important to note that regulation for SMEs is further behind than for larger businesses and therefore, as with all investment, there is a market timing risk. Solutions built today may not be fit for purpose for future regulations or they may not be required at all. Some questions to consider:

- How important will granularity and accuracy of data be in future given the status quo today?

- Will corporates and regulated entities be able to fulfil their scope 3 reporting requirements by only using external data sources and industry averages without needing to reach out to their individual suppliers?

- How will changes in AI affect the ability to create technically defensible solutions?

Despite the risks, supporting SMEs to manage and mitigate their climate and ESG risks, and thereby enabling a transition to net zero, is extremely important. Solutions built with SMEs in mind have the potential to be highly impactful and valuable investments, especially given the significant contribution of SMEs to the economy.

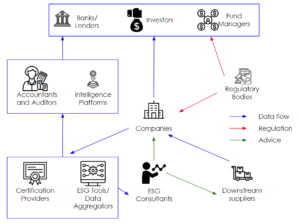

Stakeholder map of the ESG/carbon reporting market

Note: methodology

Our longlist of companies was compiled using:

- data from Crunchbase, Dealroom

- inbound applications from companies

- internet searches.

We chose to focus on companies providing B2B digital solutions as their core offering rather than those which were B2C only or largely consultancy based.

The companies were then segmented according to the following product groups:

- carbon accounting platform

- ESG assessment platform

- climate action platform

- carbon offset

- intelligence platform

- environmental impact assessment platform

- supplier management platform

- certification provider.

Information: This blog post has been produced by Nesta Impact Investments (trading name of Nesta Investment Management LLP, authorised and regulated by the Financial Conduct Authority, FRN: 485167, a wholly owned subsidiary of registered charity Nesta). The content is intended for information only, is not intended to be an invitation or inducement to engage in regulated investment activity, and is correct at the time of writing. Any companies referenced herein are included for illustrative purposes only and therefore this content should not be considered as a recommendation to invest in or an endorsement of individual products/suppliers.

With thanks to Andy Marsden of Nesta’s sustainable futures design team who helped design our logo map.